Practo Insura: A New Innovation in Insurance Technology

In the fast-changing insurance industry, it’s crucial to keep up with challenges. Practo Insura is a new software solution for Property & Casualty (P&C) insurance that helps insurers work better. It makes processes easier, improves security, and offers great experiences for users. Practo Insura aims to set new standards in insurance technology.

What are the challenges insurance industry facing today?

With over 8 years of experience, we observed insurers facing systemic inefficiencies and technological gaps that hinder their ability to adapt to modern demands. Outdated systems often pose significant barriers, preventing insurers from meeting the fast-paced expectations of today’s clients.

Policyholders now demand quicker responses, seamless access to their information, and personalized services. However, insurers are frequently ill-equipped to deliver these due to aging infrastructure and disconnected processes.

- Delays in updating insurance rates: One of the most pressing issues is the prolonged time it takes to update insurance rates. In many cases, this process can stretch over six months, leaving insurers lagging market changes and competitive pricing adjustments.

- Challenges in Policy Migration: Policy migration presents another substantial challenge. Insurers often have to wait until the end of a policy’s lifecycle to transition data to a new system, causing operational delays and inefficiencies.

- Security Risks with E-Signature Tools: Security is another critical concern. Many insurers still depend on third-party e-signature tools that, while convenient, may expose sensitive data to vulnerabilities. This lack of robust security measures puts both the insurer and the client at risk of breaches, undermining trust in the system.

- Poor management of Motor Vehicle Records (MVRs): MVR also poses a significant challenge. Staying informed about real-time violations, DUIs, and suspensions is essential for risk management, yet many insurers lack the tools necessary to handle this efficiently.

- Addressing Systemic Security Loopholes: Finally, systemic security loopholes continue to plague the industry. In an era where trust is paramount, insurers must address these vulnerabilities proactively. Without advanced encryption and compliance measures, they risk data breaches that can severely impact their reputation and operational integrity.

How Practo Insura Solves These Issues

At Practo Insura, we’ve developed innovative solutions to tackle these challenges head-on:

- Rapid Rater Algorithm: Imagine being able to update your insurance rates in just seven days instead of waiting for months. That’s the power of our Rapid Rater Algorithm. With accurate updates on premiums, fees, and coverage, you’ll always be one step ahead.

- Seamless Policy Data Migration: Switching systems can feel daunting. We’ve been there. That’s why our data migration tool makes it easy to pick up right where you left off. No downtime, no hassle—just a seamless transition to a better way of working.

- Custom E-Sign Tool: We believe in saving trees and saving time. Our built-in e-signature tool transforms policy agreements into a secure, paperless process that’s fast, easy, and reliable.

- MVR Detection: Risk management isn’t just about numbers—it’s about protecting lives and livelihoods. Our advanced Motor Vehicle Record (MVR) Detection keeps you informed with real-time alerts for violations, DUIs, and suspensions, so you can take action when it matters most.

- Reliability You Can Trust: 99.99% Uptime; We know that your work doesn’t stop, so neither does Practo Insura. With our 99.99% uptime guarantee, you can count on us to be there whenever you need us.

- Advanced Security: Insurance is built on trust, and trust starts with security. From advanced encryption to HIPAA and PCI compliance, we go the extra mile to keep your data safe.

About Practo Insura

In July 2023, we established our vision for Practo Insura. Our goal is to simplify the insurance process, making it more accessible, trustworthy, and user-friendly. We launched Practo Insura, built on over eight years of InsurTech expertise.

Practo Insura is not just another software; it is a comprehensive toolset designed to eliminate inefficiencies and make insurance operations hassle-free. By combining cutting-edge technology with an intuitive interface, Practo Insura empowers insurers to focus on what truly matters – delivering exceptional service to their clients.

Our mission is clear:

- Simplify insurance processes so that insurers can focus on their clients.

- Build trust through reliability and transparency.

- Empower insurers with tools that adapt to their needs and help them stay ahead of the curve.

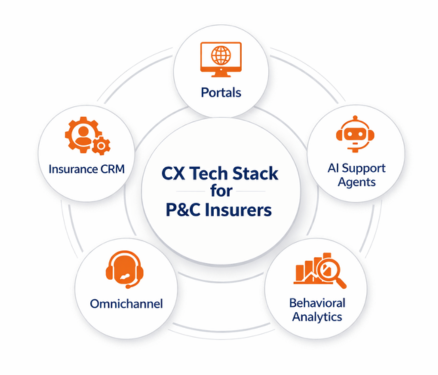

Our P&C Insurance Software Solutions

- Insurance Policy Administration: Manage policies efficiently with our user-friendly tools that handle everything from creation to updates.

- Insured Portal: Offer a seamless digital experience to policyholders with a dedicated portal that simplifies access to their policies, claims, and updates.

Practo Insura’s New Innovation Coming Soon

Practo Insura is dedicated to continuous innovation to meet industry challenges. We’re excited to enhance our insured portal, giving policyholders greater control over their insurance information with real-time updates and easy claim submissions for a better customer experience.

We’re also integrating artificial intelligence into our solutions. Our new AI Assistance feature will simplify form filling by using smart image recognition to automatically gather car details, saving time and reducing errors.

Additionally, we’re developing a Mutual Insurance Solution that streamlines the entire policy lifecycle for mutual insurers, from quoting to claims processing, ensuring efficiency and control tailored to their needs.

At Practo Insura, we’re focused on addressing current and future challenges in the insurance landscape through innovative technology.

We specialize in developing innovative Property & Casualty (P&C) insurance software solutions, leveraging over 8 years of InsurTech expertise to simplify insurance operations and enhance efficiency.