Why Strategy Comes Before Software in Insurance Modernization

In the rush to modernize, many insurers leap into software selection without a foundational strategy in place. And in a complex industry shaped by state-specific regulations, legacy infrastructure, and rising customer expectations, that shortcut can become expensive.

Modernization isn’t just about technology upgrades. It’s about making deliberate, future-focused decisions that align software capabilities with your business model, market position, and regulatory responsibilities. Strategy is the blueprint that ensures technology becomes a tool for transformation, not a source of disruption.

10 Reasons Why a Strategic Roadmap Must Come Before Any Software Investment

1. NAIC & State-Level Regulations Demand Strategic Alignment

U.S. insurance is governed by a patchwork of state regulations and NAIC (National Association of Insurance Commissioners) model laws. From cybersecurity mandates to rate-filing nuances, every software decision must align with jurisdictional requirements. Implementing tech without this foresight can lead to regulatory friction, implementation delays, or worse, non-compliance penalties.

Every major U.S. jurisdiction now enforces at least one version of the NAIC Insurance Data Security Model Law (#668), and more than 40 states require carriers to file implementation attestations. A strategy-first approach must therefore begin with a regulatory mapping exercise, linking business processes and system modules to mandates such as:

- NYDFS Cybersecurity Regulation (23 NYCRR 500) – defines encryption, MFA, and incident-reporting standards for any system processing policyholder data.

- California Department of Insurance (CDI) privacy expectations under CCPA/CPRA, including opt-out mechanisms for automated underwriting models.

- SERFF (System for Electronic Rate and Form Filing) rules that govern how rate-change workflows, form updates, and model-law filings move across state boundaries.

Embedding these checkpoints into the modernization roadmap ensures technology choices, whether PAS, rater, or claims engine, comply with every filing authority before rollout.

For example, Lemonade Inc. faced a class-action lawsuit over its claims platform’s alleged biometric data collection, highlighting the risks of privacy non-compliance. Strategic planning ensures regulatory mapping is baked into modernization efforts, not bolted on after go-live.

2. Legacy Core Systems Can’t Be Replaced All at Once

Most midsize carriers and regional insurers still rely on mainframes or outdated platforms. These systems carry business-critical logic, and replacing them outright is risky. That’s why phased modernization, decoupling components like rating, wrapping legacy with APIs, or starting with niche lines is not just wise, it’s necessary.

A strategic approach helps identify where to begin, how to avoid service disruption, and what to retire gradually. Tools like cloud-based wrappers or hybrid architecture transitions become more effective when embedded in a clear roadmap.

3. Talent Gaps and Change Management Need a People Strategy

Modernization isn’t just technical, it’s organizational. Many U.S. insurers face talent shortages in underwriting, claims, and IT. Rolling out new systems without a change management strategy leads to poor adoption, retraining costs, and stalled transformation.

Many midsize carriers lack internal resources to drive transformation alone. That’s where a specialised insurance strategic consultant brings value, with a blueprint built for your lines of business, legacy environment, and growth goals.

4. Not Every Insurtech Tool Is the Right Fit

With over $4 billion in insurtech investment in 2023 alone, the U.S. market is flooded with tools promising digital transformation. However, many don’t align with ISO-based product lines, support state filings, or integrate with your claims and underwriting workflows.

That’s where strategy comes in. A defined roadmap helps filter hype from fit. It lets insurers assess platforms for long-term value, not just flashy demos, especially when navigating complex products like HO-3 homeowners’ insurance, Workers’ compensation, or business owners’ policies (BOPs).

5. Rate Changes Must Be Fast, but Governed

With rising catastrophic losses and inflation-driven costs, insurers must react faster to market conditions. Tools like rapid rater engines allow quick configuration changes, but if those changes aren’t strategically governed, you risk pricing errors, DOI (Digital Object Identifier) violations, or version control issues.

Governance frameworks, defining who can change what, how changes are tracked, and how filings align across states, must be defined before deploying rating tools.

6. Distribution Strategy Varies by State and Product

A platform that works for personal auto in Texas might not support B2B commercial distribution in New York. Whether you sell through agents, MGAs, direct-to-consumer, or embedded channels, your strategy should guide tech selection.

Need Salesforce integration for appointed agents? Or quote-to-bind APIs for renters insurance aggregators in California? These are not one-size-fits-all scenarios. Strategic planning ensures your software stack supports your actual go-to-market motion and not just generic functionality.

7. Federal & State Data Privacy Laws Are Creating New Guardrails

As CCPA (California Consumer Privacy Act)/CPRA (California Privacy Rights Act), CPA (Certified Public Accountant), and VCDPA (Virginia Consumer Data Protection Act) gain momentum, insurers face growing data obligations across jurisdictions. Consent management, data access, and retention rules differ state by state.

Alongside CCPA and VCDPA, new statutes like the Colorado Privacy Act and Connecticut Data Privacy Act (CTDPA) impose explicit rights for deletion, data-sharing transparency, and algorithmic decision review.

A sustainable modernization roadmap should include a centralized consent-management layer that:

- Captures user consent by jurisdiction and line of business.

- Integrates with CRM, PAS, and analytics tools via APIs for real-time preference updates.

- Logs retention and deletion actions for auditability under NAIC Market Conduct Exam standards.

Strategically embedding privacy engineering at this level avoids costly retrofits once multi-state regulators harmonize AI-use disclosure requirements. Without a unified data governance strategy, insurers risk software incompatibilities or compliance violations.

8. Customer Expectations Are Being Redefined by Non-Insurance Brands

Today’s policyholders aren’t just comparing your user experience to other carriers, they’re comparing it to Amazon and USAA. Offering a disjointed, manual, or outdated experience puts retention at risk.

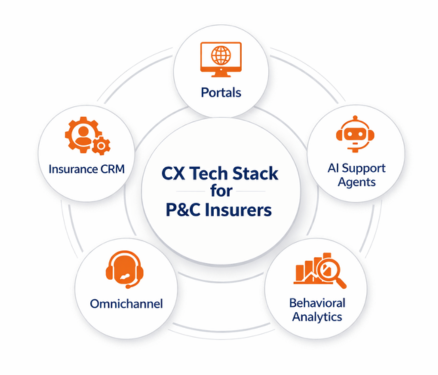

But rushing into new front-end tools without a customer experience focused strategy leads to underused features, inconsistent user journeys, or redundant tech spend. Strategic planning ensures any portal, chatbot, or self-service tool is mapped to actual customer behavior and your product portfolio.

9. AI and Automation Must Align With U.S. Fairness Laws

AI-driven claims automation and predictive analytics underwriting tools are powerful, but they come with risk. U.S. regulators, including NAIC (National Association of Insurance Commissioners) and NYDFS (New York Department of Financial Services) are scrutinizing AI for disparate impact, bias, and explainability.

As regulators tighten oversight, AI adoption in underwriting and claims must move under a formal governance framework. The NAIC AI Model Bulletin (2024) and Colorado Division of Insurance Regulation 10-1-1 already require carriers to prove that machine-learning models do not produce unfair discrimination.

A modernization strategy should therefore define:

- Model Risk Management (MRM) procedures aligned with SR 11-7 (Federal Reserve guidance) covering validation, monitoring, and documentation.

- Explainability dashboards that translate model features into regulator-friendly summaries.

- Ethical-AI committees combining actuarial, legal, and data-science teams to review models quarterly.

By codifying these controls, insurers can scale automation while meeting both fair-lending and anti-discrimination expectations across jurisdictions. Without a strategy for AI governance, insurers may inadvertently deploy models that violate anti-discrimination laws or lack transparency.

10. Tech Debt in the U.S. Market Is Expensive to Maintain

According to McKinsey, 60–70% of U.S. insurers’ IT budgets are spent on maintaining legacy systems. That leaves little room for innovation, unless modernization efforts are carefully staged and prioritized.

A clear strategy helps carriers decide what to sunset, what to integrate, and what to rebuild based on business value, not just IT timelines. It also helps avoid waste from overlapping tools or underutilised licences, ensuring modernization is cost-effective and sustainable.

Wrapping Up

For U.S. insurers, modernization is not just about buying the latest software, it’s about aligning every technology investment with regulatory obligations, operational goals, and customer expectations.

A strategy-first approach ensures:

- Regulatory compliance

- Cost control

- Faster ROI

- Superior customer experiences

Before you choose your next system or platform, ensure you have the right plan. Want help creating one? Practo Insura can help you align technology with business transformation, from data migration to rapid rating and beyond.

We specialize in developing innovative Property & Casualty (P&C) insurance software solutions, leveraging over 8 years of InsurTech expertise to simplify insurance operations and enhance efficiency.