9 Challenges P&C Insurers Face in Digital Transformation

U.S. property and casualty (P&C) insurers are under mounting pressure to modernize. Rising catastrophe losses, complex risk appetites, evolving customer expectations, and Insurtech competition are converging to force a digital reckoning. However, transforming legacy-heavy operations is not a simple tech overhaul, it’s a business-wide shift. According to a 2024 McKinsey report, 62% of P&C carriers say digital transformation is a top strategic priority, yet only 27% have fully scaled core modernization efforts.

9 Digital Transformation Challenges for U.S. P&C Insurers

1. Core Systems Burdened by Technical Debt

Many P&C insurers still operate on legacy mainframe systems built decades ago. These platforms were not designed for API integrations, real-time transactions, or digital claims journeys. These systems often lack support for emerging digital channels, making it harder to roll out self-service portals or integrate with digital brokers and claims tools.

Transitioning to a modern, cloud-native core is critical but risky. Carriers must ensure business continuity during migration and reconcile years of product complexity, custom business rules, and regulatory variation. Phased migration strategies and partner-led modernization efforts will minimize downtime and ensure that new platforms can support the full policy lifecycle.

2. Fragmented Data Across Policy, Claims & Risk

In many carriers, customer data lives in silos: policy data in one system, claims in another, and risk modelling in spreadsheets. This fragmentation blocks a unified view of the insured and limits the effectiveness of automation, analytics, and digital servicing. The result is inconsistent customer experiences, redundant manual work, and missed opportunities for cross-selling and proactive engagement.

Modern digital programs rely heavily on accurate, centralized data. Without it, predictive underwriting, real-time pricing, and dynamic claims routing become unviable. Integrating data across systems and adopting strong governance practices allow insurers to unlock insights that drive profitability and better risk management. Investing in predictive analytics for underwriting starts with addressing data structure, not just tools.

3. State-by-State Regulatory Complexity

The U.S. regulatory landscape is fragmented, with each state imposing unique requirements for rate filings, disclosures, claims processes, and data privacy. For multiline carriers, ensuring compliance across all jurisdictions during a digital rollout is daunting. Even small changes to rating logic or form delivery can trigger regulatory reviews or rejections, delaying innovation.

Digitization efforts must include built-in regulatory logic, version control for filings, and flexible workflows. This is especially important in high-regulation states like California and New York. Insurers focusing more on software than strategy may face costly rework or compliance delays.

4. Resistance to Operational Change

Legacy systems are only half the battle, the other half is legacy thinking. Employees accustomed to manual workflows or paper-heavy underwriting often resist automation or digital self-service portals. This is especially true among mid-career staff who have long operated under traditional models.

Successful transformation hinges on change management. Leaders must engage cross-functional teams early, invest in user training, and reframe technology as a tool for empowerment. Choosing the right strategic consulting partner can accelerate this shift and help align technology with human workflows.

5. Rising Customer Expectations in Claims & Policy Servicing

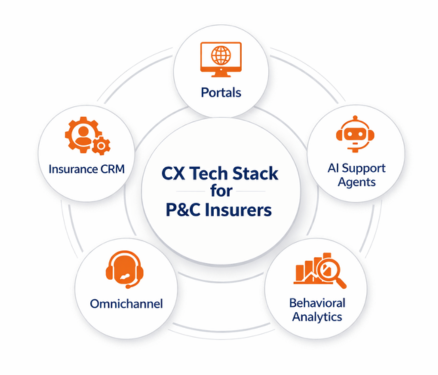

Policyholders expect instant quotes, insured portals, digital claims submission, eSign tools, and real-time updates. According to JD Power, only 46% of P&C customers in 2024 were satisfied with their insurer’s digital capabilities. Carriers that lack mobile apps, chatbots, or transparent status updates fall behind.

Investing in omnichannel portals, straight-through claims processing, and digital policy management tools is now necessary for retaining modern customers. The bar for digital engagement is rising quickly, and loyalty will increasingly depend on digital convenience.

6. Cybersecurity Risks in Multi-Vendor Cloud Environments

As insurers adopt SaaS tools and integrate with Insurtech platforms, their digital footprint grows, so does their vulnerability. Cloud misconfigurations, unpatched APIs, and weak vendor controls have led to rising breaches across the sector. Ransomware attacks targeting claims systems or underwriting tools can disrupt operations for days.

P&C insurers must embed security into every transformation layer, including third-party risk assessments, encrypted data flows, and regulatory-compliant audit trails. Compliance with state cybersecurity regulations like NYDFS (New York State Department of Financial Services) and California’s CCPA (California Consumer Privacy Act) must be actively monitored. Cyber threats aren’t just technical issues, they’re reputational and legal risks.

7. Risk of Breaking Core Operational Stability

Innovating on top of fragile systems often leads to instability. For example, layering a chatbot over a legacy FNOL (First Notice of Loss) system may create inconsistent customer experiences and break downstream claims workflows. During CAT events, such breakdowns can erode trust and delay recovery.

Stability matters, especially in peak seasons (e.g., hurricane season or wildfire claims spikes). Carriers need phased rollouts, mirrored test environments, and rollback plans to minimize operational disruption during transformation. Business continuity must be prioritized alongside innovation.

8. Integration Challenges with Insurtech and AI Vendors

P&C carriers are increasingly partnering with insurtech for AI-based underwriting, IoT property inspections, and claims fraud detection. However, integrating these solutions into outdated systems often requires costly middleware and manual reconciliation. Without proper architecture, data from insurtech partners can’t be processed efficiently.

Without API readiness and modular architecture, value from these innovations is delayed or lost. Many insurers discover that the savings these tools promise are outweighed by their integration costs. Insurers must treat integration strategy as a foundational capability, not a post-implementation patch.

9. Fuzzy ROI on Innovation Initiatives

Many digital programs launch with vague goals: “improve CX” or “modernize underwriting.” Without measurable KPIs like reduced loss ratios, faster claim cycles, or higher straight-through processing rates ROI becomes speculative. This lack of clarity undermines board confidence and weakens long-term funding.

CFOs and CIOs want transformation efforts to tie directly to business outcomes. Build business cases with data-driven baselines, operational metrics, and cost-benefit forecasts. Value-based transformation starts with proving ROI early or reducing leakage through AI-based claims validation.

5 Common Mistakes P&C Insurers Must Avoid in USA

- Viewing Digital as a Tech Project, Not a Business Strategy

Digital transformation is not just IT’s responsibility. It must be led by product, underwriting, and claims leaders with clear strategic goals from growth and compliance to customer experience. Otherwise, technology becomes shelfware. - Underestimating Change Management Needs

Failing to prepare teams for new workflows, tools, and mindsets derails even well-funded initiatives. Change enablement should be embedded from day one, with executive champions, training, and feedback loops. - Skipping Data Cleanup in the Rush to Automate

Poor-quality data leads to flawed automation, biased AI models, and compliance risks. Cleaning and structuring data before digitization is not optional, it’s foundational. - Over-Customizing Cloud Platforms to Mirror Legacy Systems

Trying to rebuild old workflows in modern systems defeats the purpose of transformation. Embrace best-practice configurations and rethink processes for the digital age. - Adopting Trending Tech Without Use-Case Fit

Jumping on new insurtech trends like blockchain, chatbots, or IoT without a defined use case leads to wasted spend. Every technology should be tied to a clear business need and measurable ROI.

Wrapping up

Digital transformation is inevitable, but successful execution is not. U.S. P&C insurers that modernize with intention, prioritizing compliance, customer value, and operational resilience, will lead the next era of insurance.

To build a connected, data-driven, and future-ready insurance operation, start with the right partners such as Practo Insura.

We specialize in developing innovative Property & Casualty (P&C) insurance software solutions, leveraging over 8 years of InsurTech expertise to simplify insurance operations and enhance efficiency.