Consulting for Carriers: Vendor Execution or Strategic Guidance?

In today’s hypercompetitive P&C insurance landscape, carriers are increasingly turning to external consultants to modernize legacy systems, optimize operations, and explore digital distribution. But there’s a fundamental question that often gets overlooked:

Are you hiring a vendor or forming a strategic partnership?

The difference is more than semantics. Choosing the wrong model can stall transformation, inflate costs, and leave your internal teams stuck in execution limbo. This guide helps P&C insurers understand what they should expect from strategic consultants and how to align with the right kind of relationship for their specific needs.

Vendor vs. Partner: Understanding the Difference

Vendor: A Transactional Executor

A vendor is typically brought in to perform a specific task, deliver a defined product, or meet a short-term need, usually under a fixed scope of work. Vendors excel at executing clearly outlined deliverables, often with minimal integration into the client’s broader strategic vision.

Think of them as specialists you hire when you already know what needs to be done. Their value lies in speed, efficiency, and cost control, but rarely in innovation or cross-functional alignment. In most cases, a vendor’s success is measured by on-time delivery and adherence to specifications, not by business impact.

Strategic Partner: A Co-Pilot for Transformation

A strategic partner, on the other hand, embeds within your organization, not just as a consultant, but as an extension of your leadership team. They don’t just ask, “What do you need us to build?” but instead ask, “What are you trying to solve?” and help co-create the answer. Strategic partners are aligned to long-term goals, not just deliverables.

They invest in understanding your underwriting goals, your claims challenges, and your modernization constraints, and tailor solutions accordingly. Their success is tied to business outcomes like operational efficiency, loss ratio improvement, or speed to market, not just deliverables met.

Here is side by side comparison between vendor and strategic partner

| Attribute | Vendor | Strategic Partner |

|---|---|---|

| Engagement Style | Delivers on fixed tasks; no involvement beyond the scope. E.g., building a compliance report. | Collaborates across departments to achieve strategic goals. E.g., redesigning claims workflows end-to-end. |

| Focus | Focused on completing what’s documented. | Focused on solving the actual business problem. |

| Flexibility | Scope changes require contract amendments. | Adapts strategy as internal priorities shift. |

| Insurance Expertise | Limited understanding of carrier-specific processes. | Deep knowledge of underwriting rules, NAIC filings, and loss ratio pressures. |

| KPIs | Success = deliverable complete, on time and on budget. | Success = measurable business outcomes. |

| Tech Approach | May push preferred tools regardless of fit. | Evaluates your stack and recommends the best fit. |

| Change Support | Leaves training and adoption to internal staff. | Leads stakeholder engagement and adoption plans. |

According to a McKinsey report, 70% of transformation initiatives fail, and one of the top causes is the lack of alignment between external vendors and internal business strategy.

Red Flags: When a Consultant Is Acting Like a Vendor

Even firms calling themselves “strategic partners” can exhibit vendor behaviors:

- Generic insurance terminology with no operational depth

- Lack of stakeholder mapping or change strategy

- Deliverables that meet specs but not outcomes

- Weak KPI ownership or performance tracking

- Over-dependence on junior consultants without carrier experience

- If they’re not invested in your success after you go live, they’re not a true partner.

What P&C Carriers Should Expect from a Strategic Consultant

Unlike vendors who fulfill predefined tasks, strategic consultants embed themselves in your business and co-own transformation.

1. P&C-Specific Domain Expertise

Modernization in insurance isn’t just about moving to the cloud, it’s about navigating regulatory frameworks, optimizing loss ratios, enhancing underwriting accuracy, and automating complex claims.

Strategic consultants should:

- Understand claims lifecycle, first notice of loss (FNOL), and subrogation flows

- Know statutory reporting requirements at the state level (e.g., California DOI vs. NAIC filings)

- Align strategies with carrier type (regional mutuals vs. national multiline carriers)

2. Outcome-Focused Project Delivery

You’re not buying hours, you’re buying results. Strategic consultants should define success around KPIs like

- Claims processing speed: This measures how quickly a claim moves from first notice of loss to settlement. A 25% reduction in cycle time, means faster payouts, reduced costs, and better customer satisfaction

- Policy issuance turnaround time: This refers to the time it takes to launch a new insurance product. Achieving this in under 90 days enables carriers to respond rapidly to market opportunities and improve speed-to-revenue.

- Expense ratio improvement: The expense ratio reflects the percentage of premium used for operational costs. Reducing it from 31% to 27% directly increases profitability and indicates greater efficiency.

- Straight-through processing rates: STP measures the percentage of workflows that are fully automated without manual intervention. Targeting 60–80% STP can significantly lower labor costs and speed up underwriting and claims.

3. Cross-Functional Integration

Modern insurance systems span policy, billing, claims, product, and analytics. A partner must work across:

- Underwriting operations

- IT infrastructure and DevOps

- Claims process improvement

- Product innovation and actuarial strategy

For example, while a vendor may work only with your IT team, a partner will bring IT, actuarial, and operations to the same table, accelerating buy-in and reducing implementation gaps.

4. Embedded Change Management

Over 50% of transformation failure is caused not by poor technology, but by human resistance to change. Strategic consultants must help carriers:

- Map internal resistance hotspots

- Train employees on new workflows

- Create stakeholder alignment sessions

- Embed change agents within departments

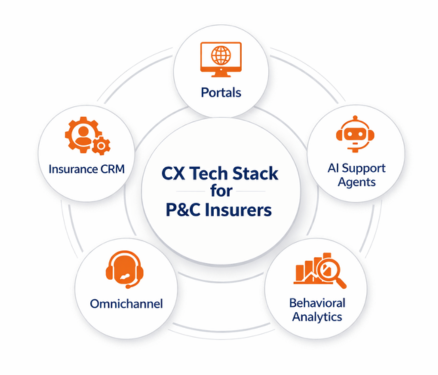

5. Technology-Agnostic Yet Informed Recommendations

You don’t need a consultant pushing their tech stack. You need one who can assess your environment and recommend the right platform for your business context.

They should know:

- Core platforms

- Integration with data enrichment APIs

- Cloud-native vs. hybrid infrastructure impact

- Scalability and adaptability towards latest tech like AI

- AI integration driven use cases to improve performance

Strategic partners must help design fit-for-purpose solutions, not force implementations around off-the-shelf tools.

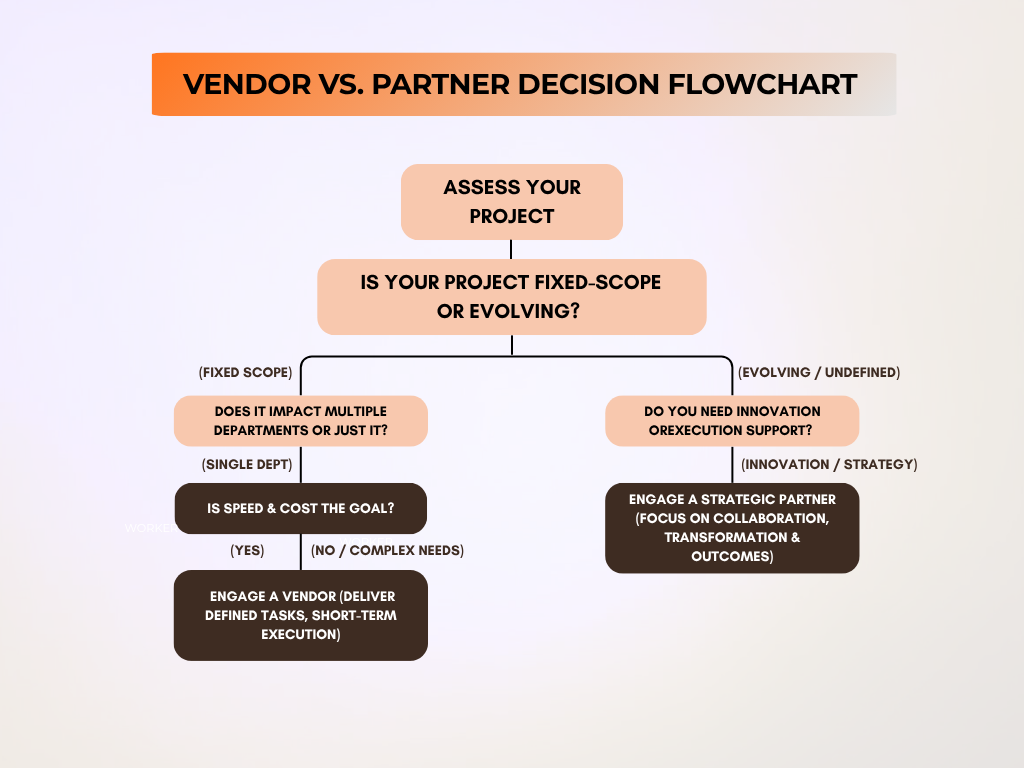

When to Use a Vendor vs. Partner: A Carrier-Specific View

Choose a Vendor When:

- You have a fixed-scope, low-risk project.

Vendors are ideal for clearly defined tasks like regulatory updates or data migration, where little strategic input is needed. - Cost and speed matter more than customization.

Vendors deliver quickly and affordably when standard solutions suffice. 63% of insurers use vendors primarily to control short-term IT costs. - Your internal team handles strategic direction.

If your teams know what needs to be done and just need execution support, vendors can efficiently carry out the plan.

Choose a Strategic Partner When:

- You’re undertaking a complex transformation.

Projects like core system replacements or cloud migrations require partners who bring structure, oversight, and risk management. - The scope is evolving, or KPIs aren’t yet clear.

Strategic partners help define metrics, refine direction, and stay agile as needs change, which is essential for innovation programmes or product launches. - The initiative involves innovation or culture change.

Partners support enterprise-wide alignment, training, and change management.

5 Questions Every Carrier Should Ask Before Engagement

- How do you measure success in P&C transformation?

- Will you support us through internal alignment and change resistance?

- Can you show measurable KPIs you’ve helped clients achieve?

- How do you integrate with our internal teams across departments?

- Are your strategies tool-agnostic, or do you push vendor products?

These questions aren’t just a checklist, they’re a lens to evaluate who will truly drive value for your organization. Pay close attention to how a consultant responds: Are they speaking your language, understanding your challenges, and anticipating risks? The right engagement begins with clarity, not contracts. Choose a partner who brings strategic insight, not just solutions.

Wrapping Up

As P&C carriers face shifting risk profiles, regulatory pressures, and digital disruption, choosing the right consultant is no longer optional – it’s strategic. Vendors can fulfill a need. But partners help redefine the future of your operations.

Looking for a strategic consulting partner that understands the unique challenges of P&C transformation?

Explore how Practo Insura’s Insurance Modernization Services help carriers navigate complexity, reduce risk, and accelerate change.

We specialize in developing innovative Property & Casualty (P&C) insurance software solutions, leveraging over 8 years of InsurTech expertise to simplify insurance operations and enhance efficiency.