Best-of-Breed and All-in-One Insurance Platform: What P&C Carriers Need to Know

In the race to modernize, U.S. P&C insurers face a crucial decision: selecting a core technology stack that can support long-term growth, regulatory agility, and operational efficiency. With policy administration, claims, billing, and customer engagement under pressure to perform better and faster, the debate often centers on two competing approaches: best-of-breed versus all-in-one models.

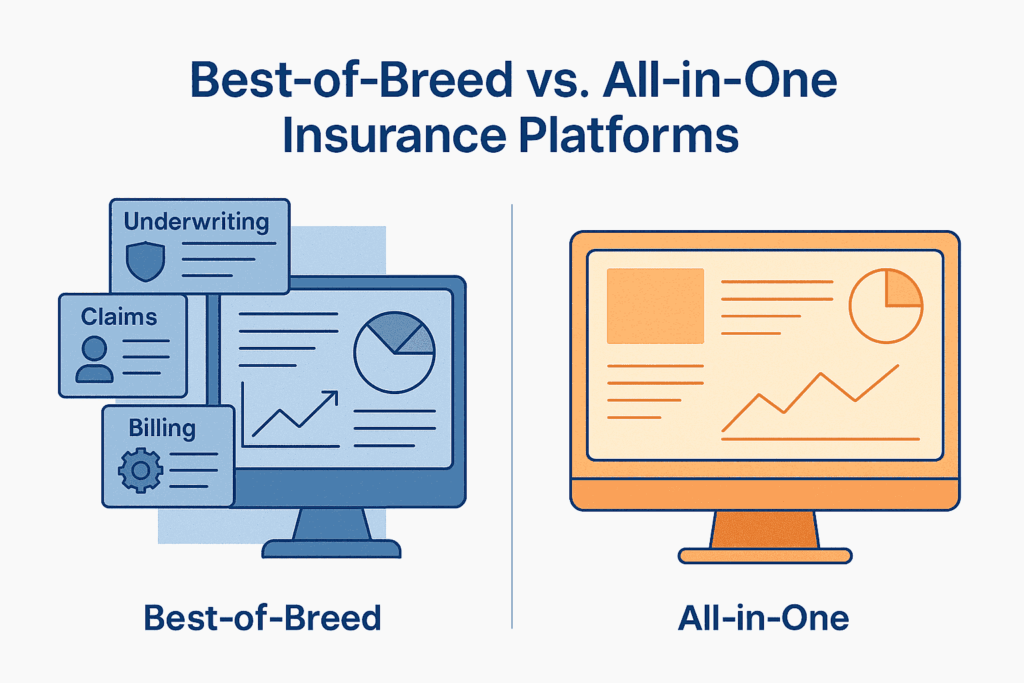

What Are Best-of-Breed and All-in-One Insurance Model?

Best-of-breed software solutions consist of individual, specialized tools that handle specific insurance functions such as underwriting, billing, or claims. In this model, insurers integrate different systems, each selected for its strength in a particular function. This approach supports flexibility and customization.

All-in-one software solutions, by contrast, deliver a comprehensive solution from a single vendor. These platforms manage the entire insurance lifecycle: quoting, underwriting, billing, claims, and more, through a unified architecture. For insurers looking to reduce IT complexity or accelerate launch timelines, all-in-one systems can offer a clear advantage.

Pros & Cons of Each Approach

Best-of-Breed Software Solution

This strategy lets insurers tap into the best technologies across vendors and prioritize capabilities where differentiation matters most. It is particularly effective for carriers with niche offerings or complex workflows.

Pros:

- Greater innovation potential and best-in-class features

- Flexibility to evolve individual components

- Better alignment with specialized business models

Cons:

- Higher integration and maintenance complexity

- Requires robust internal IT governance

- May lead to longer deployment cycles

All-in-One Software Solution

All-in-one platforms offer a more standardized, streamlined deployment. They’re ideal for insurers entering new markets, launching digital products, or operating with lean IT teams.

Pros:

- Quicker go-to-market execution

- Simplified support and vendor management

- Predictable upgrade and maintenance cycles

Cons:

- Feature limitations in certain functional areas

- Lower adaptability to unique business processes

- Vendor lock-in can limit future platform flexibility

Real-World Scenarios and Practical Considerations

A mid-market insurer with legacy systems looking to phase out outdated infrastructure may benefit from integrating a best-of-breed solution gradually, prioritizing systems with the highest return on modernization.

Conversely, a digital MGA entering a new state with bundled personal lines could benefit from the simplicity of an all-in-one solution, allowing for rapid compliance alignment and product rollout without a large IT footprint.

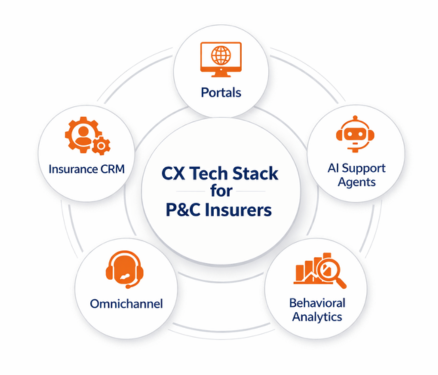

Hybrid approaches are also gaining popularity, combining all-in-one cores with best-of-breed enhancements, especially in analytics, claims automation, and CX personalization.

Side-by-Side Comparison: Best-of-Breed vs. All-in-One Platforms

| Criteria | Best-of-Breed Platforms | All-in-One Platforms |

|---|---|---|

| Integration Complexity | High: requires strong internal IT and integration tools | Low: pre-integrated systems with vendor-managed updates |

| Speed to Market | Slower due to phased deployment and integration | Faster deployment with unified systems |

| Customization | High: select best-in-class tools for specific needs | Medium: some limitations in adapting modules |

| Vendor Lock-in Risk | Low: flexible to switch modules | High: full dependency on one vendor |

| IT Resource Requirements | High: ongoing vendor coordination and oversight | Lower: simpler governance and fewer vendor relationships |

| Innovation Agility | High: easy to integrate in new tech | Medium: innovation depends on single vendor’s roadmap |

| Scalability | Flexible but complex to manage at scale | Scales easily within platform constraints |

| Ideal For | Mid-to-large insurers with strong IT teams | Digital MGAs, startups, or lean teams |

3 Key Evaluation Factors for Decision-Makers

Based on these factors, here’s how you can decide:

- Choose Best-of-Breed if you have a mature IT function, operate in a highly specialized line of business, or seek market-leading capabilities in key areas like claims automation or risk modeling. It’s the better choice when innovation speed and system flexibility outweigh implementation complexity.

- Choose All-in-One if you need fast deployment, operate with limited IT resources, or are looking to expand rapidly across markets. It’s ideal for digital MGAs, startups, or insurers seeking quick wins and operational simplicity.

- Consider hybrid or composable approaches if your long-term strategy includes both speed and specialization. This is increasingly the model of choice for midsize insurers aiming to evolve without committing fully to one end of the spectrum.

The Rise of Hybrid and Composable Approaches

Today’s platforms increasingly support composable architectures. This means insurers can start with a core platform and integrate additional services via APIs, striking a balance between best-of-breed innovation and all-in-one efficiency.

The success of this model hinges on robust data governance and enterprise-wide alignment. According to Deloitte, 70% of insurers pursuing composable strategies in 2024 cited improvements in scalability and data analytics as primary benefits.

Align Technology with Strategy

Ultimately, choosing between best-of-breed and all-in-one platforms is not just a tech decision, it’s a business strategy. What works for a regional auto carrier may be wholly unsuitable for a digital-first personal lines insurer.

Your platform strategy should reflect your risk tolerance, operational maturity, and market goals. At Practo Insura, we help insurers map these variables into actionable decisions that de-risk modernization while maximizing competitive advantage.

Whether you’re restructuring legacy systems or launching a new product line, our strategic advisory ensures that your technology investments yield results that are measurable, sustainable, and future-ready.

We specialize in developing innovative Property & Casualty (P&C) insurance software solutions, leveraging over 8 years of InsurTech expertise to simplify insurance operations and enhance efficiency.