Why Is an eSign Tool Important for Insurance Policy Management?

In today’s insurance landscape, managing policies quickly and securely is a top priority. With increasing demand for faster service and tighter compliance standards, many insurance organizations are beginning to rethink how they handle one simple but critical step-signatures.

While much of the insurance process has gone digital, the act of signing a policy still lags in many cases. Whether it’s sending out paper documents or juggling multiple PDF versions over email, these outdated methods slow everything down.

5 Pain Points of Manual Policy Signing

Traditional methods of policy signing bring more problems than solutions. They’re not only time-consuming, but they often lead to process delays, compliance risks, and frustrating experiences for both internal teams and policyholders.

Here are some common mishaps:

- Delays in policy activation: Printing, mailing, and scanning documents can stretch a simple task into days.

- Missing or incorrect signatures: Manual oversight often results in incomplete forms, requiring repeated follow-ups.

- Lack of visibility: Without a centralized system, it’s hard to track who signed and who didn’t.

- Security concerns: Email attachments and physical documents don’t offer the level of protection modern insurance data demands.

- Frustrated clients and agents: The back-and-forth of paperwork reduces satisfaction and productivity.

These challenges don’t just slow down individual transactions—they hold back the efficiency and growth of the entire operation.

5 Ways an eSignature Tool Improves Insurance Policy Management

Adapting an eSignature tool into your insurance workflow solves many of the issues above by turning a manual, error-prone process into a streamlined, trackable, and secure one.

Here’s what a modern eSignature solution can bring:

- Speed and convenience: Policies can be signed within minutes from any device, at any location.

- Built-in compliance: Digital trails, time stamps, and user authentication ensure every signature is legally valid and auditable.

- Fewer errors: Required fields, signer roles, and automated prompts reduce the chance of incomplete documents.

- Integrated workflows: eSign tools can plug into existing policy admin systems, CRMs, or cloud platforms for seamless operations.

- Better customer experience: A quick, hassle-free signing process shows clients you’re serious about service and security.

With the right tool in place, your entire policy management cycle becomes faster, cleaner, and far more reliable.

How Practo Insura’s eSign Tool Transforms Policy Management

Practo Insura didn’t just add an eSignature feature-we built one specifically for insurance professionals. Our E-Sign Tool is designed to fit directly into the day-to-day flow of policy creation, approvals, and renewals.

Keyways it transforms your workflow:

- Works across the policy lifecycle: Whether you’re issuing a new policy, handling a mid-term change, or sending out a renewal, our e-sign process is right there when you need it.

- Custom signer flows: Send documents to multiple stakeholders in a specific order, with clear roles and responsibilities.

- Real-time tracking: Know exactly where each document stands—who has signed, who hasn’t, and what comes next.

- Secure and compliant: From two-factor authentication to encrypted storage and full audit trails, every signature is protected and documented.

- Mobile-optimized: Anyone can sign securely from their phone, tablet, or desktop without compromising the experience.

Why Choose Practo Insura’s Digital Signature Tool for Your Insurance Business?

With so many e-sign tools on the market, what makes Practo Insura’s solution the right fit for insurance?

Here’s why insurers, agents, and carriers trust it:

- Tailored for insurance workflows: No need to adapt a generic tool; ours is built for the policy lifecycle.

- All-in-one platform: Integrated directly with Practo Insura’s core policy management system for full visibility.

- Easy to use: From onboarding to daily use, the tool is designed with simplicity and speed in mind.

- Regulation-ready: Every digital signature meets industry standards and is ready for audits or compliance checks.

- Scalable: Whether you’re a growing agency or a large insurer, the tool can handle volume without friction.

Practo Insura’s E-Sign Tool is more than just a digital convenience—it’s a practical solution built to simplify the real-world challenges of policy management.

Conclusion

The insurance industry is moving fast—and outdated, manual processes are no longer good enough. Paper-based policy signing is one of the last roadblocks to true digital transformation.

With a powerful, insurance-specific e-signature tool like Practo Insura’s, you can reduce delays, improve compliance, and enhance the experience for everyone involved in the policy lifecycle.

Whether you’re looking to eliminate back-and-forth emails, protect sensitive information, or just close policies faster, now is the time to make the shift.

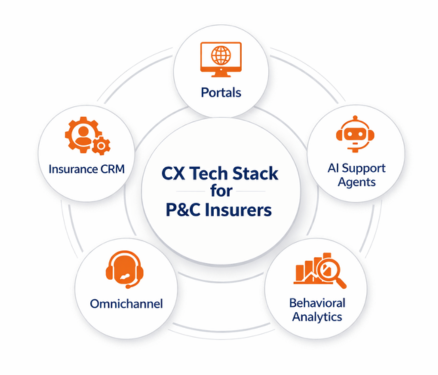

We specialize in developing innovative Property & Casualty (P&C) insurance software solutions, leveraging over 8 years of InsurTech expertise to simplify insurance operations and enhance efficiency.