How to Choose the Right P&C Insurance Software

In today’s insurance industry, efficiency, accuracy, and customer satisfaction are crucial factors for success. The right property and casualty (P&C) insurance software solution can transform operations, enhance risk management, and provide a seamless experience for clients. However, with so many options available, how can you select the best solution for your business needs? This guide outlines the essential factors to consider, ensuring that your investment delivers optimal results.

What is P&C Insurance Software?

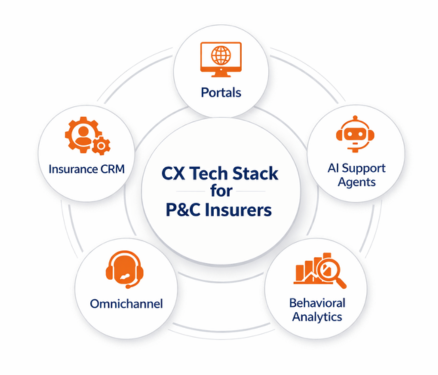

P&C insurance software is a comprehensive platform designed to streamline the management of property and casualty insurance policies. It automates critical processes such as underwriting, claims handling, policy management, and regulatory compliance, empowering insurers to operate efficiently.

By integrating advanced technologies like data analytics, artificial intelligence, and cloud computing, these solutions help insurers make informed decisions, enhance customer interactions, and remain competitive.

What are the challenges facing the insurance industry?

The insurance industry faces numerous challenges when adopting or upgrading software solutions. Common hurdles include:

- Integration Issues: Many insurers struggle to integrate new software with legacy systems, leading to inefficiencies and delays.

- High Costs: The upfront and ongoing costs of robust systems can be prohibitive, especially for smaller firms trying to stay competitive.

- Complexity: Some software solutions have steep learning curves, requiring extensive training that can slow down operations.

- Regulatory Compliance: Insurance regulations evolve constantly, making it difficult for businesses to ensure ongoing compliance without adaptable software.

- Data Security Risks: Cyber threats and data breaches pose significant risks. Ensuring software has strong encryption, access controls, and compliance with industry standards is crucial.

- Limited Customization: Many solutions offer rigid frameworks that may not meet the unique needs of insurers, forcing them to rely on inefficient workarounds.

- Lack of Real-Time Insights: Some platforms do not provide real-time analytics and reporting, limiting an insurer’s ability to make informed, data-driven decisions.

- Customer Experience Challenges: If the software is not intuitive or user-friendly, it can negatively impact customer interactions, slowing down claims processing and policy management.

Addressing these challenges requires a well-chosen software solution tailored to your organization’s unique needs.

9 Factors to Consider When Choosing P&C Insurance System

Selecting the best P&C insurance software involves evaluating various factors that align with your business needs and objectives. Below are nine critical aspects to consider:

1. Functional Capabilities and Features

Ensure the software offers comprehensive features such as policy management, claims processing, risk assessment, and compliance tracking. Look for additional functionalities like automated workflows, customizable dashboards, and AI-driven analytics to maximize efficiency.

2. Scalability and Growth Potential

Choose a solution that can grow with your business. As your customer base and operational requirements expand, the software should accommodate increased data volumes and new functionalities without compromising performance.

3. Integration with Existing Systems

The software should seamlessly integrate with your current systems, such as CRM platforms, accounting software, and third-party APIs. This ensures a unified workflow and eliminates the need for costly and time-consuming system overhauls.

4. User-Friendly Interface

A simple, intuitive interface reduces the learning curve for employees and minimizes errors. Look for software that provides a positive user experience with clear navigation, real-time insights, and robust support resources.

5. Compliance and Risk Management

Insurance companies must adhere to strict regulatory standards. The software should include tools to simplify compliance monitoring and reporting while offering risk management features such as fraud detection and claims validation.

6. Cost and Return on Investment (ROI)

Evaluate the software’s pricing structure, including setup costs, subscription fees, and ongoing maintenance expenses. Compare this with the potential ROI, such as reduced operational costs, improved customer satisfaction, and increased efficiency.

7. Data Security and Privacy

Cybersecurity is paramount in the insurance industry. Ensure the software provides advanced encryption, multi-factor authentication, and compliance with standards like HIPAA and PCI to safeguard sensitive data.

8. Reputation and Support

Research the vendor’s reputation by reading reviews, case studies, and testimonials. Opt for a provider known for reliability, excellent customer service, and robust support during implementation and beyond.

9. Analytics and Reporting

Analytics capabilities are essential for data-driven decision-making. The software should offer real-time reporting, predictive insights, and customizable metrics to help you monitor performance and identify trends.

How Practo Insura Simplifies P&C Insurance

Practo Insura is designed to address the specific needs of modern insurers, offering innovative solutions that streamline operations P&C insurance management with cutting-edge technology. It enables rapid rate updates, allowing insurers to stay competitive by implementing new pricing in just seven days. Policy data migration is seamless, eliminating downtime and ensuring uninterrupted operations.

With built-in e-signature tools, policy agreements become paperless and hassle-free. Real-time fraud detection provides instant alerts on policyholder violations, improving risk management. A 99.99% uptime guarantee ensures reliability, while advanced security measures, including encryption and token-based authentication, safeguard sensitive data.

Practo Insura is designed to enhance efficiency, security, and user experience, making insurance operations smoother and more effective.

Conclusion

Choosing the right P&C insurance software is a critical decision that can transform your operations and customer experience. By considering factors such as functionality, scalability, compliance, and security, you can select a solution that aligns with your goals.

Practo Insura simplifies this process with its advanced features, ensuring efficiency, reliability, and peace of mind for your business. Ready to make the switch? Request a demo today and discover how we can simplify your insurance operations.

We specialize in developing innovative Property & Casualty (P&C) insurance software solutions, leveraging over 8 years of InsurTech expertise to simplify insurance operations and enhance efficiency.