What Is an Insurance Rater Engine and How Does It Speed Up Quotes?

In an industry where speed, precision, and adaptability are critical, the traditional approach to rating insurance policies is no longer sustainable. Manual rule changes, developer-dependent updates, and slow quote delivery are holding insurers back.

That’s where a modern insurance rater engine comes in, transforming how carriers and MGAs generate quotes, respond to regulatory shifts, and improve risk pricing.

What Is an Insurance Rater Engine

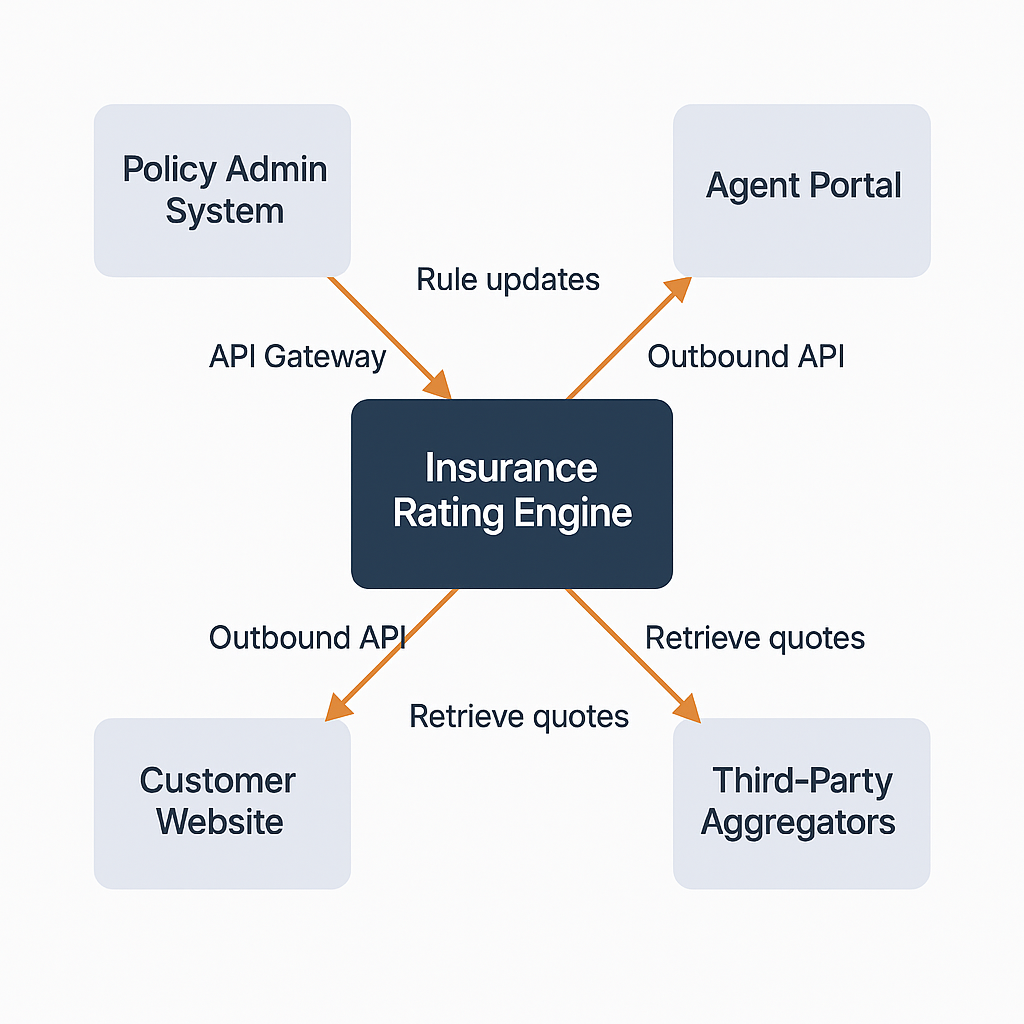

An insurance rating engine is centralized system that automatically calculates insurance premiums based on defined rules, risk factors and regulatory requirements. It collects data from user like, age, location, type of coverage, or claim history and instantly applies defined rating logic to return an accurate quote. It also makes sure every quote reflects your underwriting rules and state regulations correctly.

How It Works

- Input Collection: It collects data such as driver details, vehicle type, location, property characteristics, or coverage limits.

- Rule Application: The engine applies rate tables and formulas defined by actuaries or product managers:

- Base premium lookup

- Application of factors (age, risk zone, coverage level)

- Discounts, surcharges, or fees

- Premium Calculation: The engine runs the logic sequentially or through a parallel algorithm, combining all applicable rating rules.

- Output Delivery: It returns the calculated premium (and sometimes a breakdown) via an API to:

- Agent portal

- Customer website

- Policy administration system (PAS)

- Aggregator platform

5 Issues with Current Rating Systems

Even today, many insurers still rely on rigid, outdated systems that make it difficult to compete in a digital-first market. Common pain points include:

- Hardcoded Rating Logic: Requires developer involvement for every pricing update.

- Inflexible Architecture: Minor changes require full testing cycles and redeployment.

- Disjointed Data Sources: Pricing, quoting, and underwriting systems often work in silos.

- Slow Market Response: It can take weeks or months to implement new pricing strategies.

- Limited Transparency: Business users can’t test or preview the impact of pricing changes easily.

These limitations slow down operations, increase compliance risk, and reduce profitability.

How to Update Insurance Rates Faster on Software

Speeding up rate updates and quote delivery requires the right system architecture. Here’s how insurers can accelerate the process.

1. Select a System with a Built-in or Easy-to-Fit Rating Engine

Speed matters in modern insurance pricing. Choose a system with built-in or easily integrable rating engine. This allows you to update rates, factors, and discounts quickly, without long development cycles or system downtime.

The Practo Insura Rapid Rater Engine connects seamlessly with your policy administration system, agent portals, and aggregator platforms, ensuring consistent and compliant quotes across every channel.

With Practo Insura, your product and underwriting teams can build, test, and publish new rate logic within seven days, helping you react faster to market changes, regulatory updates, or competitive shifts, all while maintaining accuracy and control across your pricing ecosystem.

2. Use Rule-Based or No-Code Rate Configurations

Traditional rating systems require developers to hardcode rules, which creates bottlenecks and increases the cost of change. A modern system uses a rule-based configuration engine that enables rating logic to be built from dropdowns, variables, and conditions.

Business users can set rate rules based on:

- Driver age and accident history

- Property location and occupancy status

- Multi-policy bundling or loyalty programs

- Credit score tiers or usage patterns (for telematics)

These rules can be layered, tiered, and conditioned dynamically, without touching backend code. This flexibility enables rapid testing, minimizes time-to-market, and reduces errors introduced through manual intervention.

3. Automate Regulatory Compliance Updates

Rate changes are often driven by compliance, especially in auto, property, and Worker compensation insurance. In a multi-state environment, manual compliance management becomes unscalable and risky.

Employ a system that would:

- Track which products are impacted by each jurisdiction’s updates

- Maintain audit trails for every change

- Provide effective dating to ensure changes apply on the correct date

- Offer sandbox testing to simulate regulatory impacts before deployment

4. Enable API-Driven Rate Deployment

Today’s quoting environments are omnichannel, users expect consistent pricing whether they’re using a mobile app, talking to an agent, or comparing rates on an aggregator site.

This consistency is only possible if your rating engine is API enabled.

With API-driven deployment:

- Updated rates propagate instantly across all channels

- Your distribution partners (brokers, agencies, MGAs) always quote using the latest logic

- Your own web portals and CRMs fetch accurate rates directly from the engine

5. Implement Rate Testing & Simulation Tools

Before going live, it’s crucial to understand the impact of rate changes, especially when introducing new rules or modifying base premiums.

Some engines include built-in tools to:

- Run simulations across your entire book of business

- Test pricing outcomes across customer personas or demographics

- Evaluate performance against KPIs like quote-to-bind ratio or loss ratio

- A/B test rule changes in a controlled environment

6. Schedule Rate Changes

Scheduling capabilities are often overlooked, but they’re critical for aligning launches with regulatory deadlines, marketing campaigns, or fiscal strategy.

With effective scheduling:

- Rate changes can be programmed to activate on specific dates

- Multi-phase rollouts can be executed in stages (e.g., by region or product)

- Carriers can avoid manual updates at midnight on deadline day

What Does the Rapid Rater Algorithm Do?

Behind the scenes, the Rapid Rater algorithm is what powers the speed and flexibility of a modern rating engine. Here’s what it enables:

- Applies Rating Logic Without Code Changes: Business teams can create, edit, and publish pricing logic without touching the codebase.

- Lightning-Quick Rate Implementation: Rather than taking weeks, rate updates are released in a matter of days or even hours.

- Supports Complex Rating Structures: Handles multi-variable logic, layered conditions, and geographic-specific rules with ease.

- Integrates Seamlessly with Policy Systems: Pricing updates reflect instantly across quoting, policy issuance, and renewals.

This algorithm ensures fast execution while maintaining accuracy, auditability, and system stability.

6 Benefits of Using a Rater Engine in Insurance

Implementing a modern insurance rater engine unlocks several high-impact benefits:

- Accurate Pricing: Quick rate update after a change in regulatory compliance. Reducing underwriting leakage and avoiding mispriced risks.

- Self-Serve Configuration: Empower product and pricing teams to control rules directly.

- Lower IT Dependency: Free up development resources for strategic initiatives.

- Real-Time Market Responsiveness: Adjust rates instantly in response to market or regulatory shifts.

- Improved Customer Experience: Deliver more accurate, competitive pricing through every channel.

- Reduced Operational Costs: Lower change management overhead and reduce quote-to-bind time.

These benefits aren’t just operational, they’re strategic, helping insurers stay competitive in an increasingly digital ecosystem.

Conclusion

As insurance continues to digitize, legacy rating systems are becoming a liability. To deliver real-time quotes, remain compliant, and adapt pricing quickly, insurers must invest in modern rater engines.

Practo Insura offers the flexibility, speed, and control that modern carriers and MGAs need. From no-code configuration and simulation tools to regulatory automation, it equips your team to price smarter and faster.

If you’re ready to reduce quote delays, empower your underwriters, and compete with data-driven precision, it’s time to reimagine your rating process with the right platform.

We specialize in developing innovative Property & Casualty (P&C) insurance software solutions, leveraging over 8 years of InsurTech expertise to simplify insurance operations and enhance efficiency.